Liable budgeting and monetary arranging should really constantly be your Most important technique. Money-borrowing apps should be regarded a last resort when surprising emergencies disrupt your very carefully outlined programs.

Potential for poor monetary techniques: Owning swift use of these kinds of loans could contribute to overreliance on personal debt, that may find yourself replacing audio budgeting behavior.

A $15 payment may well utilize to every eligible purchase transaction that delivers your account detrimental. Balance needs to be introduced to a minimum of $0 in just 24 hours of authorization of the main transaction that overdraws your account to avoid a payment. Overdraft defense is barely available on qualified Demand from customers Deposit Accounts. Log in in your account and refer to your Account Agreement to check feature availability.

After approved, you may preserve using the app: When You need to undergo an approval course of action, as you go through it, you are able to preserve utilizing the payday advance aspect. This differs from a bank loan, which necessitates you to reapply each time you would like much more money.

If you Obtain your upcoming paycheck, Empower will deduct the quantity it advanced to you personally to harmony your account. Furthermore, in the event you deposit your paycheck to the Empower Card, as opposed to your personal checking account, you’ll also Obtain your paycheck up to two times early.

Activated, customized debit card required to make a lender transfer. Boundaries use to bank transfers. Subject matter to the bank’s constraints and charges.

While A fast loan might get more info be a lifesaver during hardships, it’s not constantly the most suitable option. Stay clear of using a money-borrowing app bank loan to approach for repeat expenses, like cellular telephone expenses or groceries. Also, don’t rely on these financial loans for indulgent buys or objects you haven’t budgeted for.

A considerable danger with utilizing a money-borrowing app is the consequences of missing payments. With regards to the conditions, apps may well add late costs, raise your fascination level, or both of those. Late or missed payments also can impact your credit history rating, making it challenging to borrow again in the future.

You can even contemplate asking friends and family for financial loans, which can provide low or zero fascination, greater restrictions, fewer headache and in some cases lessen regular payments.

Overdraft charges might trigger your account to be overdrawn by an sum that is greater than your overdraft protection. A $fifteen price may well apply to every eligible acquire transaction that delivers your account detrimental. Balance needs to be brought to not less than $0 in 24 several hours of authorization of the main transaction that overdraws your account in order to avoid a fee. Overdraft protection is only obtainable on Need Deposit Accounts that satisfy eligibility specifications. Log into and seek advice from your Account Arrangement to examine characteristic availability.

Brigit's Instantaneous Money characteristic offers a $250 progress for qualifying Additionally members. Brigit provides a free of charge strategy, which comes with financial scheduling equipment to monitor expending plus a Market for chances to receive further earnings.

To qualify you’ll really need to setup an eligible direct deposit of at the very least $five hundred from a employer or A different payroll supplier. There won't be any credit checks to qualify and when you’d like instantaneous use of your advance you pays a price, if not you can wait 3 company times to obtain it for free2.

You'll need to obtain an once-a-year earnings of no less than $forty,000, plus a FICO score 660 or increased, for being eligible. In case your credit rating is truthful or lousy, you'll need to go somewhere else, as Find does not allow cosigners.

Versatility: Select your loan quantity and in many cases choose a repayment selection that suits your preferences. Cons

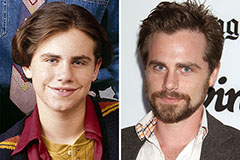

Rider Strong Then & Now!

Rider Strong Then & Now! Bradley Pierce Then & Now!

Bradley Pierce Then & Now! Charlie Korsmo Then & Now!

Charlie Korsmo Then & Now! Bill Murray Then & Now!

Bill Murray Then & Now! Katey Sagal Then & Now!

Katey Sagal Then & Now!